Second-best carbon taxation in a differentiated oligopoly

Diego S. Cardoso. (working paper)

Abstract

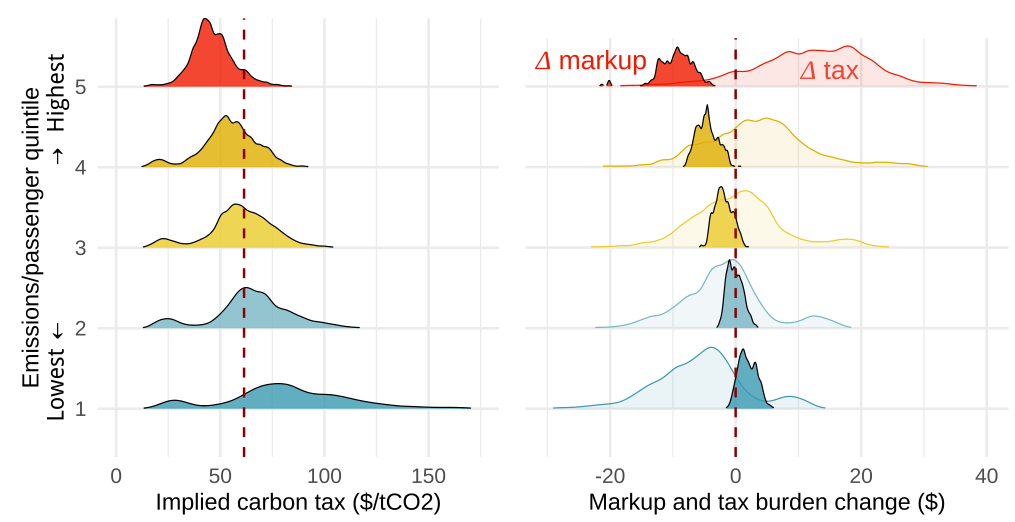

Corrective environmental taxes are typically designed to match the value of marginal damages. This approach maximizes social welfare when an environmental externality is the only market imperfection. When multiple imperfections exist, however, knowing the marginal damages is insufficient for setting an optimal tax: it is also necessary to understand the market structure and quantify the effects of imperfections. This paper examines second-best carbon taxation in the US domestic aviation sector and documents novel empirical evidence of the large distortive effects of market imperfections on the efficiency of carbon taxes. Combining sufficient statistics and structural modeling approaches, I estimate abatement costs, calculate the optimal carbon tax under market power and non-environmental taxes, and investigate the effects of introducing a revenue-neutral carbon tax. I find that the current marginal abatement cost is 211–244 USD/ton CO2. Hence, any positive carbon tax would decrease social welfare if the social cost of carbon (SCC) is smaller than this value. Under a higher SCC of 300 USD/ton CO2, the optimal carbon tax is 107 USD/ton CO2, thus much lower than the standard Pigouvian tax. Moreover, attempting to improve policy efficiency with a revenue-neutral carbon tax would not yield a double dividend. While welfare gains would follow from reducing the tax deadweight loss and market power, price effects would be dampened by markup adjustments, leading to a net increase in aggregate emissions