An econometric analysis of the Brazilian merger policy

Diego S. Cardoso, Mariusa M. Pitelli, and Adelson M. Figueiredo. 2021. Review of Industrial Organization. 59, 103–132._ (paper)

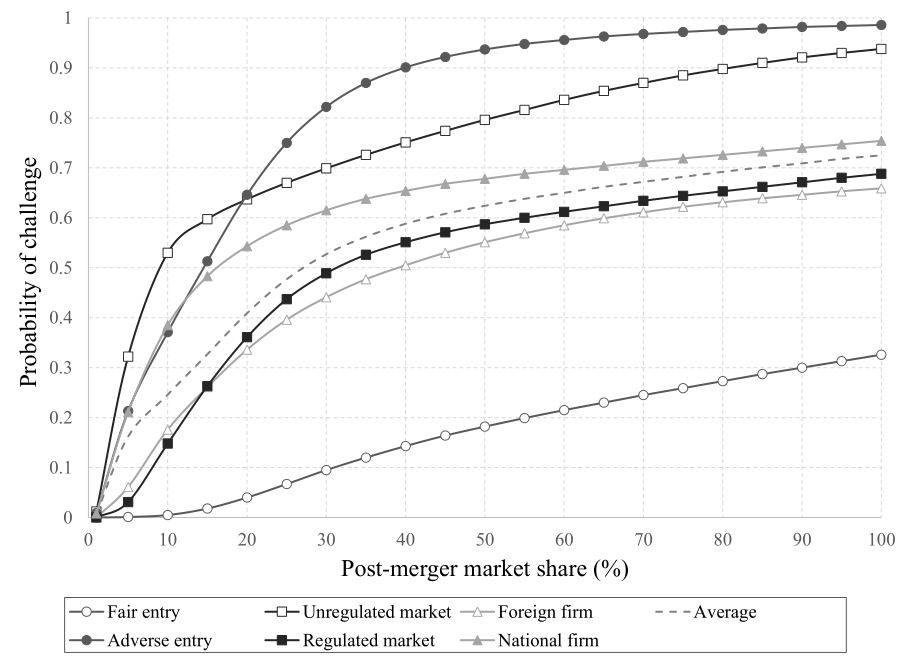

Abstract This paper analyzes the factors influencing the decisions made by the Brazilian Competition Policy System on merger operations from 2004 to 2011. Estimates of binomial logit models show that two standard market structure indicators – high post-merger market share and unfavorable entry conditions - significantly increase the likelihood of an operation being challenged. Additionally, we find that three factors not explicitly associated with the Brazilian Merger Guidelines play a relevant role in merger policy decisions. Specifically, mergers in regulated markets, involving vertical integration or having a foreign firm as the largest participant are less likely to be challenged.